USDCAD Analysis – April 29, 2020.

Thoughts

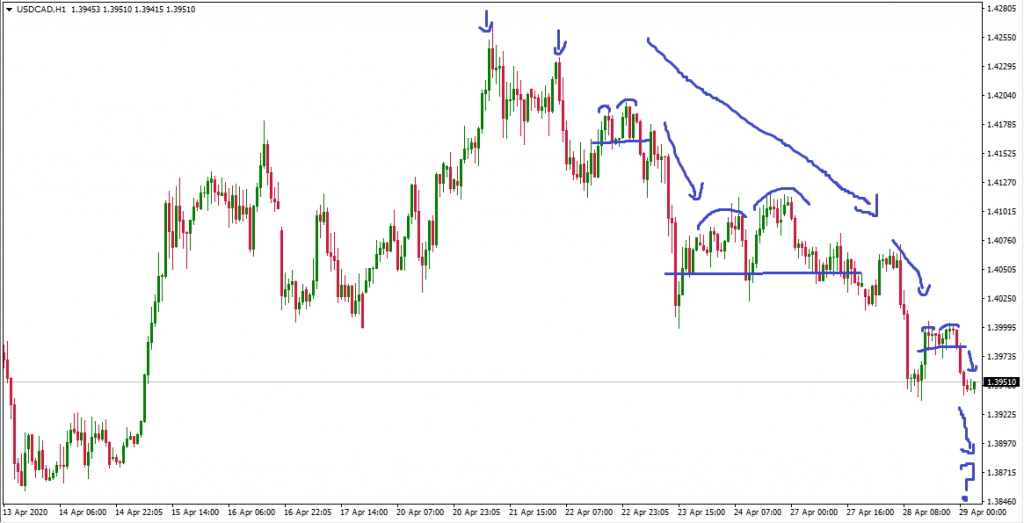

The price of USDCAD reversed from an uptrend into a downtrend starting on the 21st of April, 2020. The previous trend hit resistance around the 1.4236 region.

Since the price has been declining progressively forming a series of double top patterns at every rally caused by hitting a support zone.

The latest support is the one around the 1.3951 region, which was first reached by this current trend on the 28th of April. The price pulled back formed a double-top pattern and is back at the support region.

Our Recommendation

Provided the price breaks through the current support, which in our opinion is most likely to happen, the price will move down onto the next support.

Traders can take sell positions once the price breaks below the support. Take-profit levels should be set before the next support. Preferably about 30 pips from the current support.

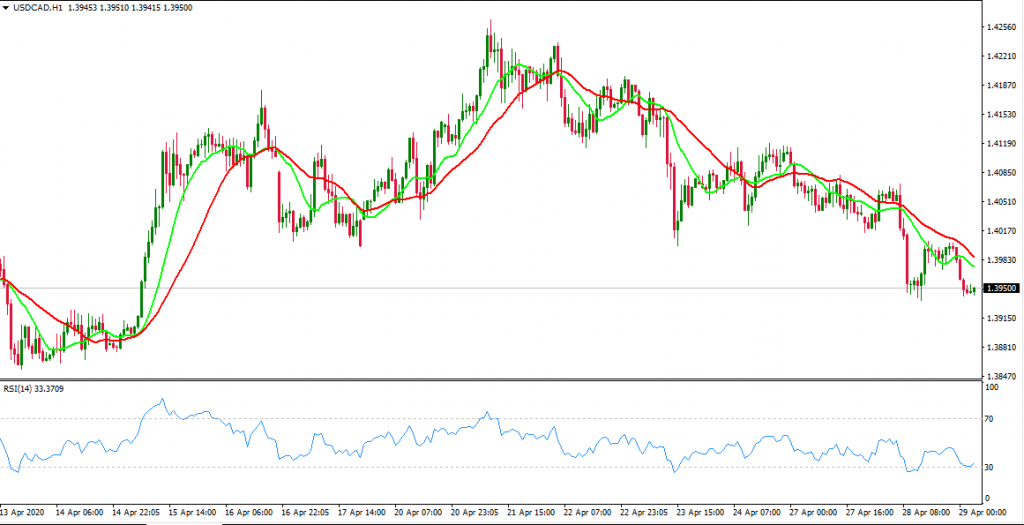

Our position is further reinforced by moving averages, with the shorter period moving average (lime) being below the longer period moving average (red), indicating a downward slope.

The RSI value is also above the 30 levels (oversold).

Thank you for reading! Feel free to ask questions and comment. Do well to subscribe to our newsletter to receive updates about new posts. Also, follow us on social media and avail yourself of the different tools available on this platform. You can also read more of our blog.